Grotech Ventures, a prominent global technology investor, spearheaded the investment round, with participation from renowned firms such as Aquiline Technology Growth, Impact Engine, Mission One Capital, New Climate Ventures, and CreativeCo Capital.

The funding was further bolstered by ongoing support from existing investors, including Tech Square Ventures, SoftBank Opportunity Fund, Circadian Ventures, Knoll Ventures, SaaS Ventures, and Panoramic Ventures. These resources will be utilized to propel the advancement of Cloverly’s cutting-edge digital infrastructure, renowned in the industry for its excellence in facilitating voluntary carbon markets. Notably, the investment will enable the development of a new supplier platform, empowering buyers, suppliers, and virtually any company to effortlessly expand their environmental impact.

Additionally, the Series A funding will contribute to the exponential growth of Cloverly’s workforce, as well as the establishment of a second headquarters in London, to cater to the surging global demand from customers.

Revolutionizing an Essential Sector through Innovation

The Intergovernmental Panel on Climate Change (IPCC) emphasizes that the deployment of carbon dioxide removal (CDR) is essential to achieve net zero CO2 or GHG emissions, given the challenge of reducing hard-to-abate residual emissions. The voluntary carbon market (VCM) emerges as a pivotal tool for immediate climate action, effectively addressing unavoidable emissions alongside the substantial reductions needed to combat climate change in the long run.

To meet global emissions targets, the National Academy of Sciences asserts that an additional 10 billion tonnes of carbon dioxide must be removed annually by 2050. This urgent requirement propels remarkable growth in these markets, with projections indicating a value of approximately $50 billion by 2030, as estimated by McKinsey and the Taskforce on Scaling Voluntary Carbon Markets.

Nevertheless, despite this growth and the sense of urgency, the VCM currently lacks several crucial components necessary to drive significant impact on a large scale.

Since its inception, Cloverly has been diligently addressing the challenges of access, convenience, trust, and transparency within the realm of carbon credits. As the pioneering API for carbon credits, the company has evolved into a trailblazer, driving the VCM with its state-of-the-art digital infrastructure.

This has led to esteemed partnerships with global leaders including American Express, Salesforce, Visa, and many others. Businesses now have the ability to swiftly expand their climate action by directly procuring high-quality carbon removals or seamlessly integrating Cloverly’s technology into their own offerings, services, or supply chains.

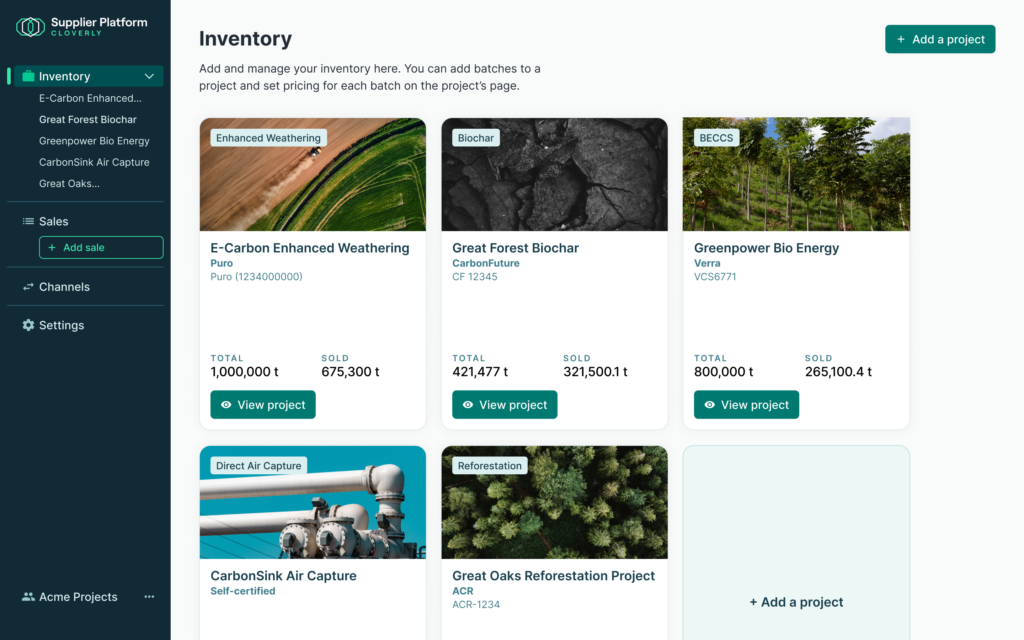

Moreover, project suppliers can enhance their scalability by harnessing the power of the Cloverly Marketplace™ and utilizing Cloverly’s supplier software, which facilitates crucial commercial operations like inventory management, multi-channel distribution, and credit sales tracking. The newly introduced supplier platform showcases innovative credits from esteemed suppliers such as Tradewater, Therm, KOKO Networks, and CarbonCure.

Rahul Misra, CarbonCure’s Head of Carbon Product and Operations, expressed admiration for Cloverly’s unwavering support in expanding the distribution of carbon credits. “Cloverly has been an exceptional champion in our efforts to scale the distribution of carbon credits,” he stated. “Their invaluable contribution lies not only in showcasing our solution but also in fostering a genuine partnership. This partnership is crucial as we navigate the ever-evolving voluntary carbon market and engage with a diverse array of credit buyers.”

The Demand within the Market

Consumer spending data provides compelling evidence not only for the urgent need to address climate change but also for the widespread public desire to embrace sustainable choices in our daily lives. According to a 2022 report by NielsenIQ, 30% of consumers exhibit a higher inclination to purchase sustainable products. Additionally, a 2022 study conducted by the Wharton School of Business reveals that two-thirds of consumers are willing to pay a premium for sustainable products. For businesses, incorporating climate action into user experiences and product development represents a significant opportunity to tap into this well-established market demand.

Jason Rubottom, CEO of Cloverly, emphasized the necessity for immediate action, stating, “We cannot afford to wait; action is needed now.” He further highlighted the vital significance of the voluntary carbon market, which reflects an unprecedented demand for solutions enabling businesses and consumers to actively contribute to critical climate action. Cloverly, uniquely positioned to facilitate such engagement, exemplifies this commitment through its recent successful funding round.

Lawson Devries, the general partner at Grotech Ventures, reflected on their due diligence process and the feedback received from numerous Cloverly customers. He noted the remarkable passion expressed by these customers towards Cloverly’s product and team. As a result, it became evident that Cloverly had not only secured its position as a global leader in a substantial market but also delivered tangible value to its stakeholders while making a positive impact in the broader battle against climate change. Devries expressed enthusiasm in joining this journey, stating, “We are thrilled to be a part of Cloverly’s mission and contribute to their ongoing success.”

About Cloverly

As the pioneering API for carbon credits, Cloverly embarked on its journey and has evolved into the cutting-edge digital infrastructure that fuels the voluntary carbon markets. Committed to scaling impactful climate action, Cloverly has gained the trust of over 200 enterprises globally. These enterprises represent a diverse range of industries including financial services, technology, ESG/carbon accounting, supply chain, eCommerce, and more. Moreover, numerous prominent project developers and suppliers rely on the robust Cloverly platform to effectively manage their carbon credit operations.

About Grotech Ventures

Established in 1984, Grotech Ventures has emerged as a prominent investor in promising technology companies during their early stages. The firm actively seeks out innovative ventures across the expansive technology landscape, providing support and adding value throughout the entire lifecycle of each portfolio company. With a substantial pool of financial resources, extensive industry connections, and profound domain knowledge, Grotech Ventures is well-equipped to accelerate the growth of its portfolio companies. With over $1.0 billion in committed capital, Grotech Ventures extends its support to early-stage enterprises through investments starting at $500,000.