Venture capital firm Step Venture has announced the first close of its Step Fund at €30 million, marking the operational launch of one of Italy’s most ambitious early-stage investment vehicles.

The fund aims to reach €50 million by final close, with a hard cap of €80 million, and will focus on seed-stage Italian startups with strong potential for international scalability.

The fund’s anchor investor is CDP Venture Capital Sgr, which committed €20 million via the Digital Transition Fund – PNRR (DTF), financed by the EU’s NextGenerationEU initiative. Additional backers include Zest, Reale Mutua, and Add Value.

“Venture capital is now a key lever for Europe’s economic growth — especially as AI and digital technologies reshape markets and production models,” said Michele Novelli, Partner at Step Venture.

Strengthening Italy’s innovation ecosystem

The launch comes amid a surge of activity in Italy’s early-stage venture scene. Recent fundings such as Skillvue (€5.5M), SylloTips (€4.2M), and Lexroom (€16M) highlight investor confidence in AI-powered B2B software and digital transformation — core areas of Step Fund’s investment thesis.

Step Fund will focus on FinTech, HealthTech, B2B software, and connected-world technologies, where AI serves as a key enabler. The team’s goal is to back around 20 startups, combining capital, hands-on operational expertise, and international networks to accelerate growth beyond Italy.

A fund built by founders for founders

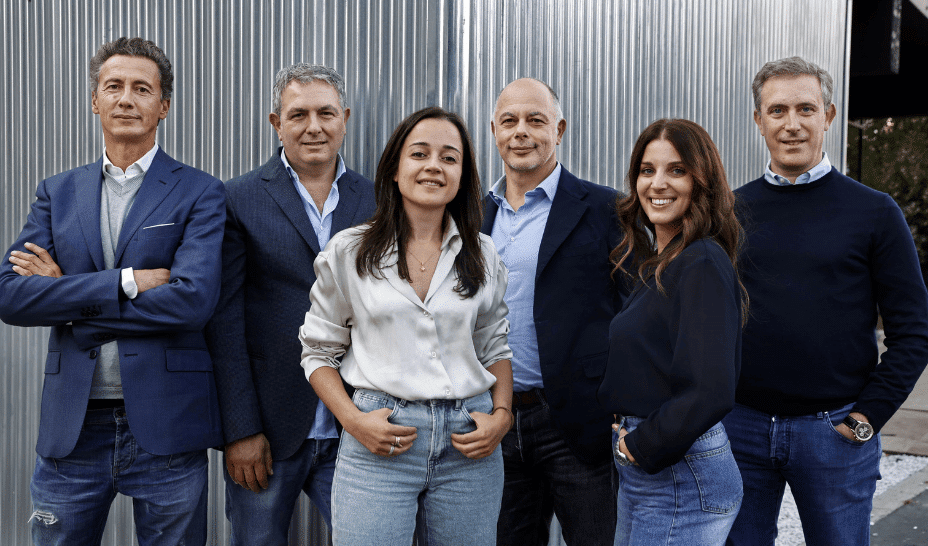

Founded in 2022 by Maria Imbesi, Roberto Montandon, Michele Novelli, and Gennaro Tesone, Step Venture brings together seasoned founders and investors who have built, scaled, and exited tech companies across Europe — with successful outcomes involving Xerox, Telefónica, Klarna, +Simple, Blackstone, and TripAdvisor.

“We’re not traditional financiers — we’re entrepreneurs first,” said Novelli. “Less than 0.1% of startups we review receive investment. For those that do, our involvement is a mark of quality and a true partnership from idea to exit.”

Anchored by CDP, aligned with Italy’s digital transformation

Enrico Filì, Head of the Digital Transition Fund – PNRR at CDP Venture Capital Sgr, said:

“Our investment in Step Fund is a key step in accelerating Italy’s digital transition — especially in Southern Italy, which will receive at least 20% of the fund’s resources. We have great confidence in the Step team’s ability to drive international success for their portfolio companies.”

Step Fund will operate from offices in Milan and Naples, ensuring nationwide coverage while nurturing talent from emerging regions, particularly in the South, in line with Italy’s National Recovery and Resilience Plan (PNRR).

Managed by Alternative Capital Partners

The fund is managed by Alternative Capital Partners Sgr (Acp Sgr), an Italian asset management firm known for thematic and sustainable investment strategies. A dedicated Investment Committee composed of all Step Venture partners has been established.

“With Step Fund, we’re strengthening our position as an innovative, multi-strategy asset manager,” said Emanuele Ottina (CEO) and Ofelia Harder (Senior Manager, Business Development and Fundraising) at Acp Sgr. “The combination of CDP’s support, corporate investors, and the Step Venture team’s proven track record positions the fund to deliver both financial and sustainable impact.”

About Step Venture

Step Venture is a Milan-based venture capital firm investing in AI-driven digital startups across FinTech, HealthTech, B2B software, and connected-world technologies. Through the Step Fund, it supports early-stage Italian innovators with global potential, guided by an entrepreneurial approach and a commitment to responsible investment under SFDR Article 8+.