Dublin-based Seapoint, an AI-powered financial home for startups and mid-market companies, has raised $3M in pre-seed funding led by Frontline Ventures, with participation from Tapestry VC and the former COOs of Stripe, Revolut, Tide, and Tines.

Mid-market companies (10–250 employees) make up a third of Europe’s economy but remain underserved by both neobanks and traditional corporate banks. Most rely on 4–6 different financial tools stitched together manually, with over 90% still running processes by hand and half earning no interest on cash deposits.

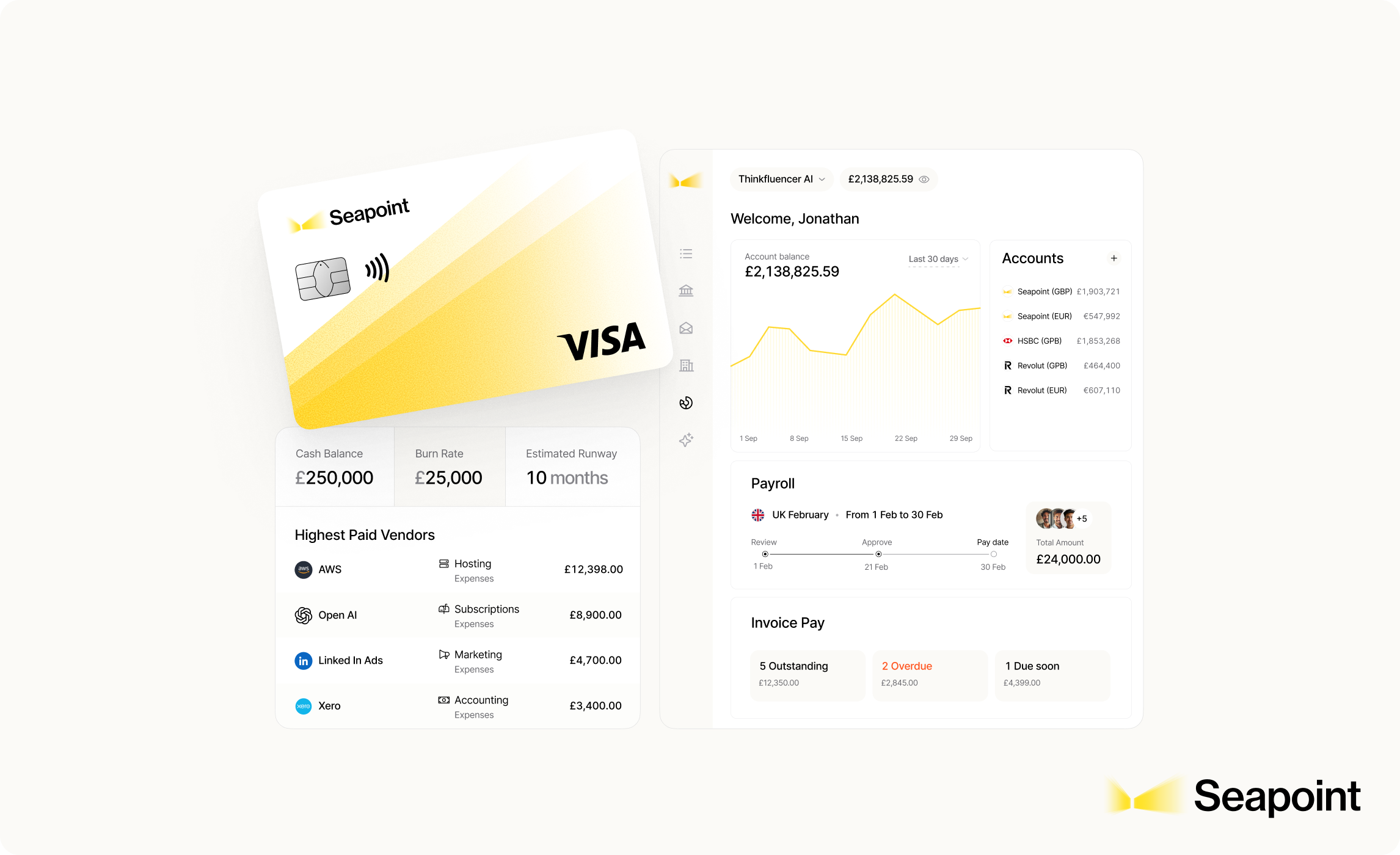

Seapoint wants to change that. Its platform combines regulated business accounts, cards, payments, payroll, expenses, treasury, and reporting—all automated with AI. Founders get real-time visibility of their finances, while repetitive tasks like invoice processing, payroll, and expense categorization happen in the background.

CEO Sean Mullaney, former European CIO at Stripe and ex-CTO at Algolia, said:

“AI can transform finances for scaling companies. Within minutes, Seapoint connects to bank accounts, accounting software, and email to automate bookkeeping, payroll, and payments. It’s broader and more powerful than traditional banking, giving founders real-time clarity and more runway.”

Early traction and next steps

The platform is currently in private beta, already serving dozens of VC-backed startups, including Kota, the employee benefits platform that recently raised $14.5M.

Luke Mackey, co-founder of Kota, said:

“Seapoint gives us a bird’s-eye view of finances and replaces multiple vendors for cards, expenses, payroll, and invoices. It’s an immediate win.”

The new funding will fuel team growth and expansion across the UK and Europe.

Why it matters

Will Prendergast, Partner at Frontline, commented:

“Neobanks serve consumers well, but mid-market companies have more complex needs. With a deeply experienced fintech team, Seapoint is leveraging AI to rebuild the finance stack for scaling businesses.”

Founded in 2024, Seapoint is built by alumni from Stripe and Tide who have lived the problem first-hand. The company positions itself as the financial home for European startups and scale-ups, aiming to replace fragmented, manual finance stacks with a single AI-driven platform.