Revolut has reached a landmark €65 billion ($75 billion) valuation after a significant secondary share sale, marking one of the largest private-market valuations ever achieved by a European tech company.

The transaction drew in new heavyweight investors for the first time, including Andreessen Horowitz, Franklin Templeton and NVIDIA’s venture arm, NVentures.

A New Milestone In The Global Banking Vision

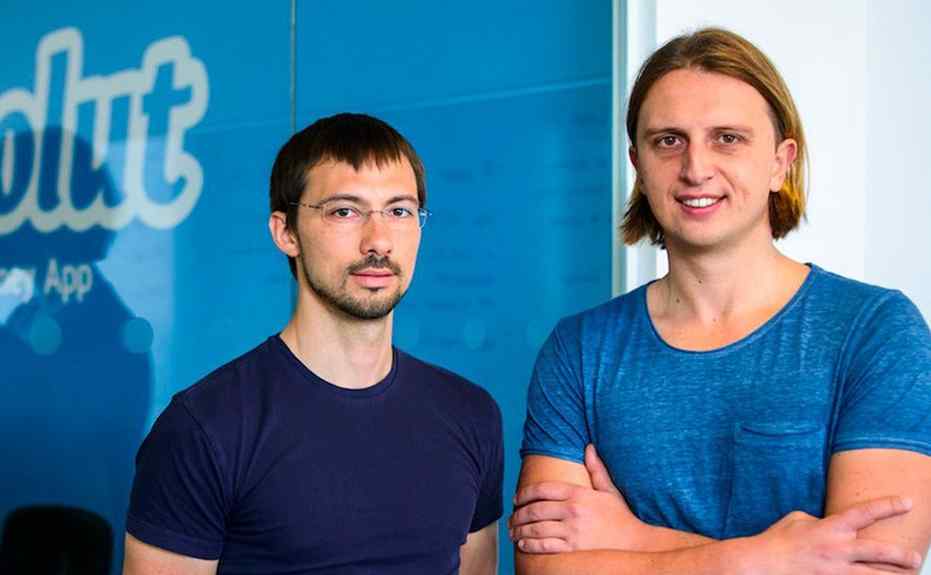

CEO and co-founder Nik Storonsky described the development as a testament to the company’s rapid global expansion. Revolut now aims to build the first fully global bank, with ambitions to reach 100 million users in 100 countries. Storonsky credited the team’s relentless drive for placing a European FinTech at the forefront of global financial innovation.

A Strong Year For European FinTech

This milestone arrives amid active FinTech investment across Europe in 2025. Zilch raised €150M to scale its payment network, Finary secured €25M for its wealth-tech platform, Teybridge Capital Europe received €50M for SME finance, Flowpay raised €30M in debt to grow embedded lending and Due closed an additional €6.3M for its stablecoin payments API. Together, these deals total roughly €261.3M—highlighting a healthy ecosystem, though still overshadowed by Revolut’s unprecedented valuation leap.

Long-Term Growth Tracked Across Multiple Markets

Revolut’s trajectory has been closely followed in recent years, from applying for a European banking license and expanding into Asia, to building in-house payments infrastructure and launching major markets such as France and Mexico. In 2025, Revolut also advanced its dual-headquarters model, scaled its AI-driven operations and acquired Berlin-based TravelTech startup Swifty as part of a broader global strategy.

Revenue Surge And Global Expansion

According to CFO Victor Stinga, the company’s rising valuation reflects a business model combining fast growth with strong profitability. Revolut reported €3.4B in revenue in 2024—up 72% year over year—and €1.2B in pre-tax profit, a 149% increase. The platform now serves over 65 million users, with business banking contributing €867M in annualized revenue.

Strengthened By New Strategic Investors

The secondary share sale, the company’s fifth liquidity event, allowed employees to sell up to 20% of their vested shares. The addition of top US investors—including NVentures—marks a major turning point as Revolut accelerates expansion into Latin America, Asia and North America. The company recently obtained regulatory approval to launch banking services in Mexico and Colombia and is preparing a market entry into India.

Aiming For 100 Countries By 2030

The firm plans to expand into 30 new markets currently under development, aiming to serve 100 million customers across 100 countries by the end of the decade. As one of the ten most valuable private tech companies globally, Revolut is positioning itself to become the world’s first truly global financial platform.

About Revolut

Revolut is a global financial technology company headquartered in London, offering a unified platform for banking, payments, investments, insurance and cryptocurrency services. Serving more than 65 million customers worldwide, Revolut provides fast, flexible and borderless financial tools while expanding into new markets as part of its mission to build the world’s first fully global bank.