As European venture capital grapples with a tougher funding climate—raising just €2.3 billion across 24 funds in Q1 2025—some firms are standing out by doubling down on conviction and strategy.

One of them is KOMPAS VC, which has just closed its second fund at €150 million, reaffirming its commitment to backing next-generation founders building transformative industrial technologies.

Investing Where Innovation Meets Impact

Founded in 2021, KOMPAS VC focuses on startups at the intersection of decarbonisation, productivity, and resilience—particularly in legacy industries like manufacturing and the built environment, two of the world’s biggest emitters and most under-digitized sectors.

“With Fund II, we’re not just investing in startups. We’re investing in the industrial evolution,” said Sebastian Peck, Partner at KOMPAS VC.

The firm plans to invest in up to 25 early-stage companies developing deeptech solutions for critical challenges, from supply chain security to carbon footprint reduction and AI-powered industrial automation.

Investing Where Innovation Meets Impact

Founded in 2021, KOMPAS VC focuses on startups at the intersection of decarbonisation, productivity, and resilience—particularly in legacy industries like manufacturing and the built environment, two of the world’s biggest emitters and most under-digitized sectors.

“With Fund II, we’re not just investing in startups. We’re investing in the industrial evolution,” said Sebastian Peck, Partner at KOMPAS VC.

The firm plans to invest in up to 25 early-stage companies developing deeptech solutions for critical challenges, from supply chain security to carbon footprint reduction and AI-powered industrial automation.

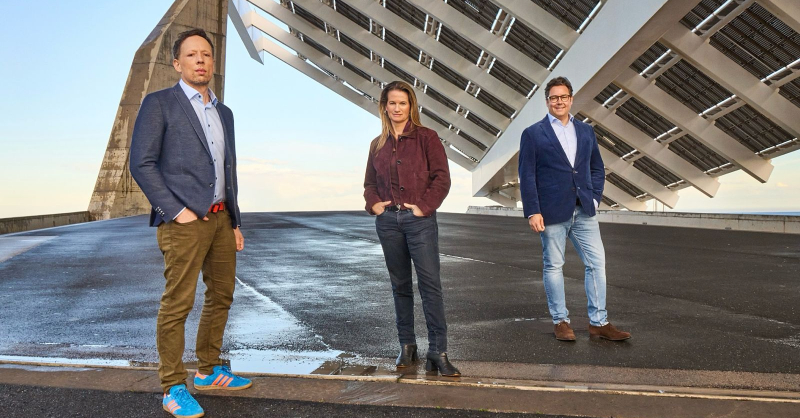

Experienced Operators Driving the Mission

KOMPAS is led by a team with rare frontline experience:

- Sebastian Peck previously backed Circular and Battery Resourcers.

- Talia Rafaeli supported companies like UBQ and Ecotech in material innovation.

- Andreas Winter-Extra brings years of operational insight from Volvo Cars, smartworks innovation, and Volvo Cars Tech Fund.

Together, they leverage their OEM backgrounds and vast networks to not only fund startups—but to actively support them with market access, recruitment, and deep industrial insight.

A High-Conviction Strategy Backed by Strong LPs

The close of Fund II—secured in a cooling VC market—speaks volumes about LP confidence. Many of KOMPAS’s original backers from Fund I have reinvested, validating the firm’s strong track record and its hands-on approach to industrial innovation.

KOMPAS VC doesn’t just provide capital—it partners closely with founders to build companies from the ground up, helping them scale across Europe, the US, and Israel from offices in Amsterdam, Berlin, Barcelona, and Copenhagen.

A Portfolio Built to Power Industrial Transformation

Fund II builds on an already impactful portfolio that includes:

- Prewave – Risk intelligence platform reducing supplier disruption; raised $67M

- Makersite – AI for product and supply chain design; raised $18M

- Again – Converts captured CO₂ into essential green chemicals; raised $43M

- Ecoworks – Net-zero retrofit platform for buildings; raised €40M

- Findable – AI for real estate documentation; raised €2M

Each reflects KOMPAS’s core thesis: solving climate and efficiency challenges at the application layer of industrial tech.

“We use our industry networks not only to evaluate startups—but to understand when technologies are actually ready for adoption,” said Peck. “That gives us a real edge.”

Vision for a Greener, More Resilient Future

As industrial players face growing geopolitical and environmental pressure, KOMPAS is helping them unlock new capabilities in AI, robotics, material science, and synthetic biology—turning innovation into strategy.

“We’re entering a new era where resilience and sustainability are non-negotiable,” said Talia Rafaeli. “To thrive, industries must harness the transformative potential of today’s most promising technologies.”

“We cannot afford to treat sustainability as a buzzword,” added Andreas Winter-Extra. “It must be embedded in the hardware, software, and business models of tomorrow. That’s the only way to ensure economic growth doesn’t come at the cost of climate, health, or biodiversity.”

With Fund II, KOMPAS VC is positioning itself as one of Europe’s leading forces in industrial deeptech—building a portfolio that doesn’t just chase returns but helps redefine what a smarter, cleaner, and more resilient industrial future can look like.