Toronto-based fintech startup Keep has raised $12 million in a Series A1 round to grow its financial platform built for small and medium-sized businesses (SMBs).

The round was led by Tribe Capital, with participation from Rebel Fund, Liquid 2 Ventures, Cambrian, Assurant Ventures, and angels like Dropbox co-founder Arash Ferdowsi and Webflow CEO Vlad Magdalin.

This latest funding brings Keep’s total equity funding to $23 million, alongside a $50 million credit facility from Treville Capital Group and a $3 million venture debt line from Silicon Valley Bank.

Designed as “mission control” for SMB finances

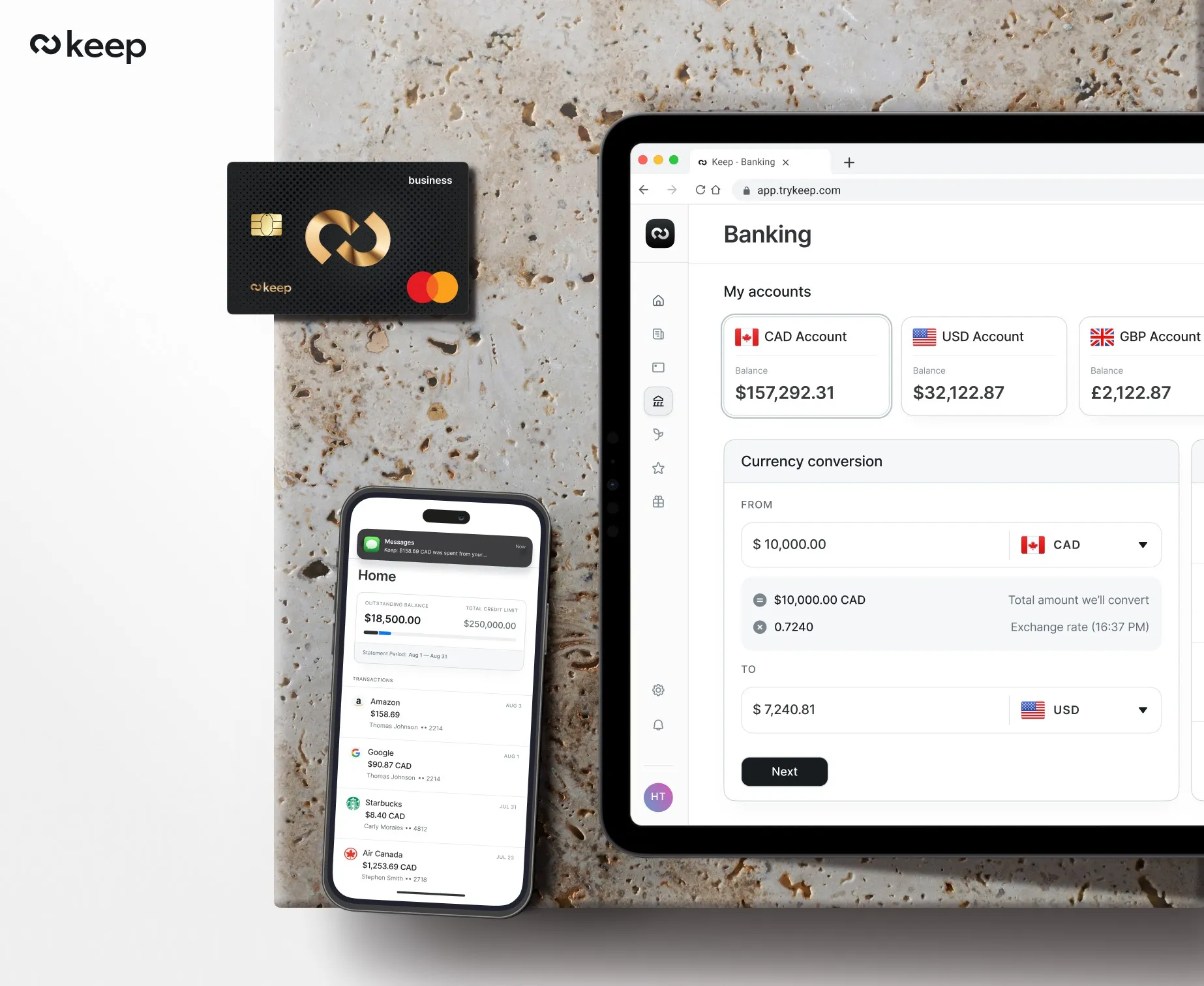

Founded in 2021 by Y Combinator alum Oliver Takach and co-founder Helson Taveras, Keep provides a suite of financial tools tailored to SMBs, including corporate credit cards, multi-currency accounts, automated expense management, and accounting software integrations. The company says its offering addresses long-standing gaps left by traditional banks.

After launching its corporate card in 2023, Keep now serves more than 3,000 businesses and hit $14 million in annualized revenue in 2024. Its monetization strategy includes interchange fees, premium payment services, and short-term capital lending.

International edge and future roadmap

Keep differentiates itself from domestic rivals like Float Financial through its multi-currency capabilities, enabling clients to “bank like a local” across borders. This feature has proven especially useful for customers with international operations.

Looking ahead, Keep plans to launch a new banking product and introduce features like embedded credit and bill pay, aiming to become a comprehensive financial hub for SMBs.

Backers see vertical integration as key

Tribe Capital co-founder Arjun Sethi called vertically integrated fintech platforms “the new standard,” emphasizing that features like seamless FX, expense controls, and fund access are now essential for modern businesses.

With this funding, the company is solidifying its position in a market that’s rapidly heating up and positioning itself as a dominant player in Canada’s evolving SMB fintech landscape.