Givefront, a Y Combinator–backed fintech startup focused exclusively on nonprofits, has raised $2 million in seed funding.

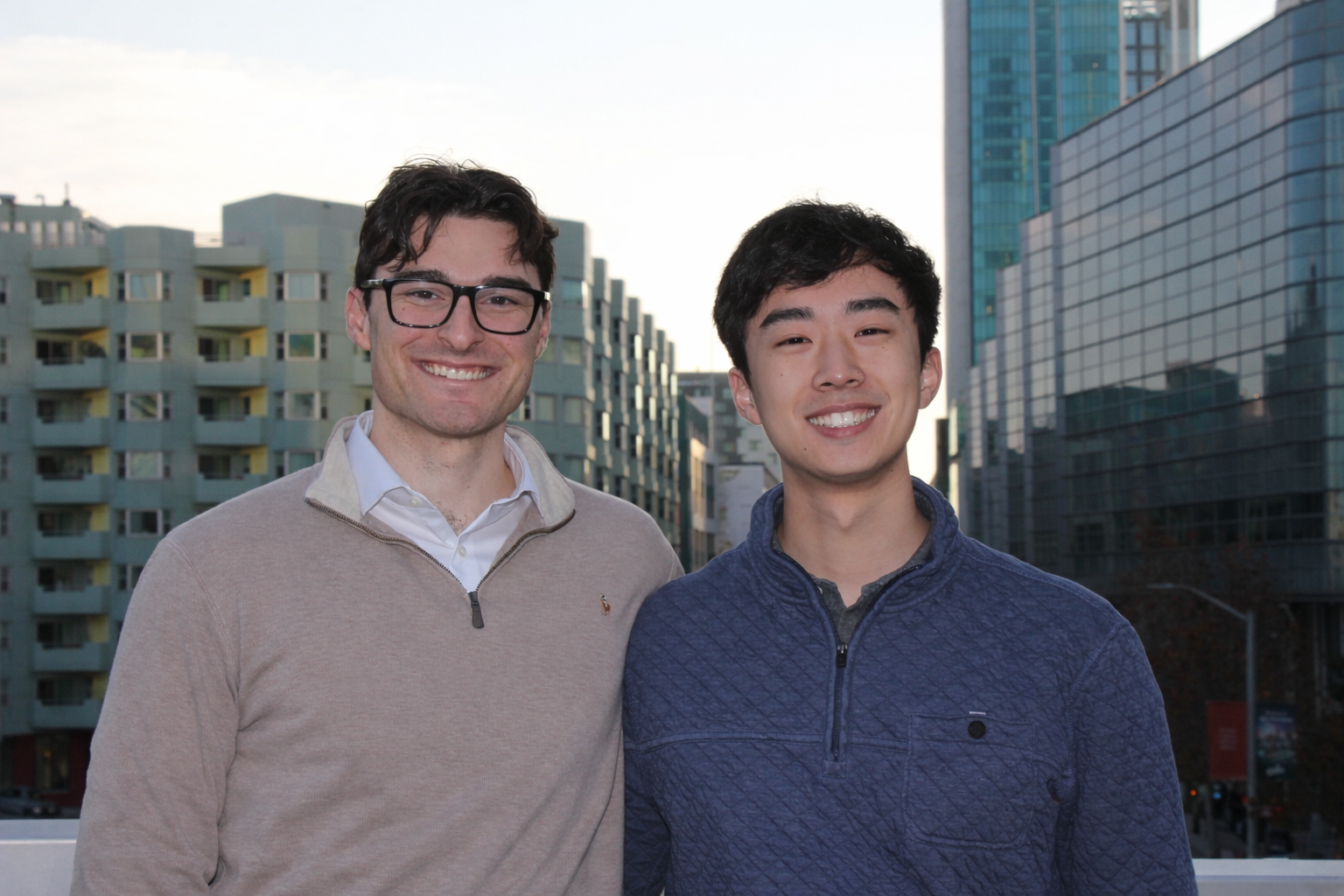

The company was founded by 21-year-old Harvard dropout Matt Tengtrakool alongside UC Berkeley student Aidan Sunbury, with the goal of bringing modern financial tooling to organisations long ignored by mainstream fintech innovation.

While the past decade has seen startups like Brex, Ramp, and Mercury redefine how startups and enterprises manage money, nonprofits have largely been left behind. Givefront aims to close that gap with a financial platform purpose-built for charities, NGOs, churches, animal rescues, homeowner associations, and similar organisations.

A massive sector still running on outdated tools

Nonprofits account for roughly 6 percent of US GDP and move trillions of dollars each year. Despite this scale, most still rely on legacy financial systems that lack real-time controls, modern approval workflows, and easy integrations.

Tengtrakool’s interest in the space grew through hands-on experience. Before Givefront, he experimented with a microloan aggregation startup in Nigeria and later worked inside several nonprofits while studying computer science and statistics at Harvard. In one organisation, he helped scale donations to nearly $500,000.

Those experiences highlighted a recurring issue: nonprofits face strict regulatory and reporting requirements, yet lack access to the financial infrastructure that businesses take for granted.

He has said that many of the tools nonprofits depend on are out of sync with modern expectations, making compliance and operational oversight unnecessarily difficult.

From internal tool to nationwide platform

Givefront began as an internal solution to help organisations Tengtrakool worked with manage spending and compliance. As interest grew, the product expanded to serve nonprofits across the US. The team ultimately narrowed its focus to a unified financial platform built specifically for registered nonprofits, of which there are around 1.9 million nationwide.

When the company joined Y Combinator in Winter 2024, the initial vision included banking and accounting. The founders soon learned that asking nonprofits to replace their accountants or core banking relationships created long, slow sales cycles. That insight led to a pivot toward cards and spend management.

Switching payment cards proved far easier than replacing entire accounting stacks, allowing Givefront to gain traction more quickly.

Built for nonprofit realities, not startups

While Givefront’s product may resemble corporate spend platforms on the surface, its underlying workflows are designed around nonprofit-specific needs. These include managing restricted and unrestricted funds, tracking grant-based budgets, handling donor and foundation reporting, and supporting IRS Form 990 disclosures.

Many nonprofits juggle dozens of grants at once, each with its own spending rules. Legacy systems like Blackbaud, Sage, and MIP remain dominant but often lack modern controls and automation.

Rather than replacing those systems, Givefront integrates with them, acting as a vertical layer that adds real-time spend controls, automated receipt capture for audits, grant-level budgeting, and compliance-ready reporting.

The company positions this approach as significantly more effective than adapting generic corporate tools to nonprofit use cases.

Rapid early growth and expansion plans

Givefront earns revenue through card interchange and subscriptions tied to its bill pay functionality. Over time, the company plans to expand into payroll, banking, budgeting, and potentially endowment and investment management.

Since launching its cards around six months ago, Givefront has onboarded hundreds of nonprofits and reports more than 200 percent month-over-month growth in both revenue and total payment volume. The team expects to serve around 1,000 organisations by the end of the year, with a longer-term target of 5,000 nonprofits by mid-next year.

Churches and religious organisations have shown particularly strong adoption. Many rely on volunteer treasurers rather than full-time finance staff, making automation especially valuable.

Backed to scale distribution and product

The $2 million seed round was led by Script Capital, with participation from Y Combinator, C3 Ventures, Phoenix Fund, and angel investors including the CEOs of Chariot and Wealthfront.

The new funding will be used to scale distribution, grow the team, and further develop Givefront’s card and bill pay offerings as the company works to modernise financial operations across the nonprofit sector.