London-based Bracket has secured $7 million in seed funding to expand its AI-powered FX, treasury and cash management platform built for mid-market businesses.

The round was led by Macquarie Group through its Commodities and Global Markets division, alongside Blackfinch Ventures. Existing investor Failup Ventures also participated.

The funding comes as growing numbers of mid-sized companies look to replace spreadsheets and manual workflows with integrated treasury infrastructure that delivers real-time visibility and automation.

Addressing The Treasury Gap In The Mid-Market

While large enterprises typically rely on sophisticated treasury systems, many mid-market businesses still manage foreign exchange exposure, liquidity and bank connectivity through fragmented tools and manual processes.

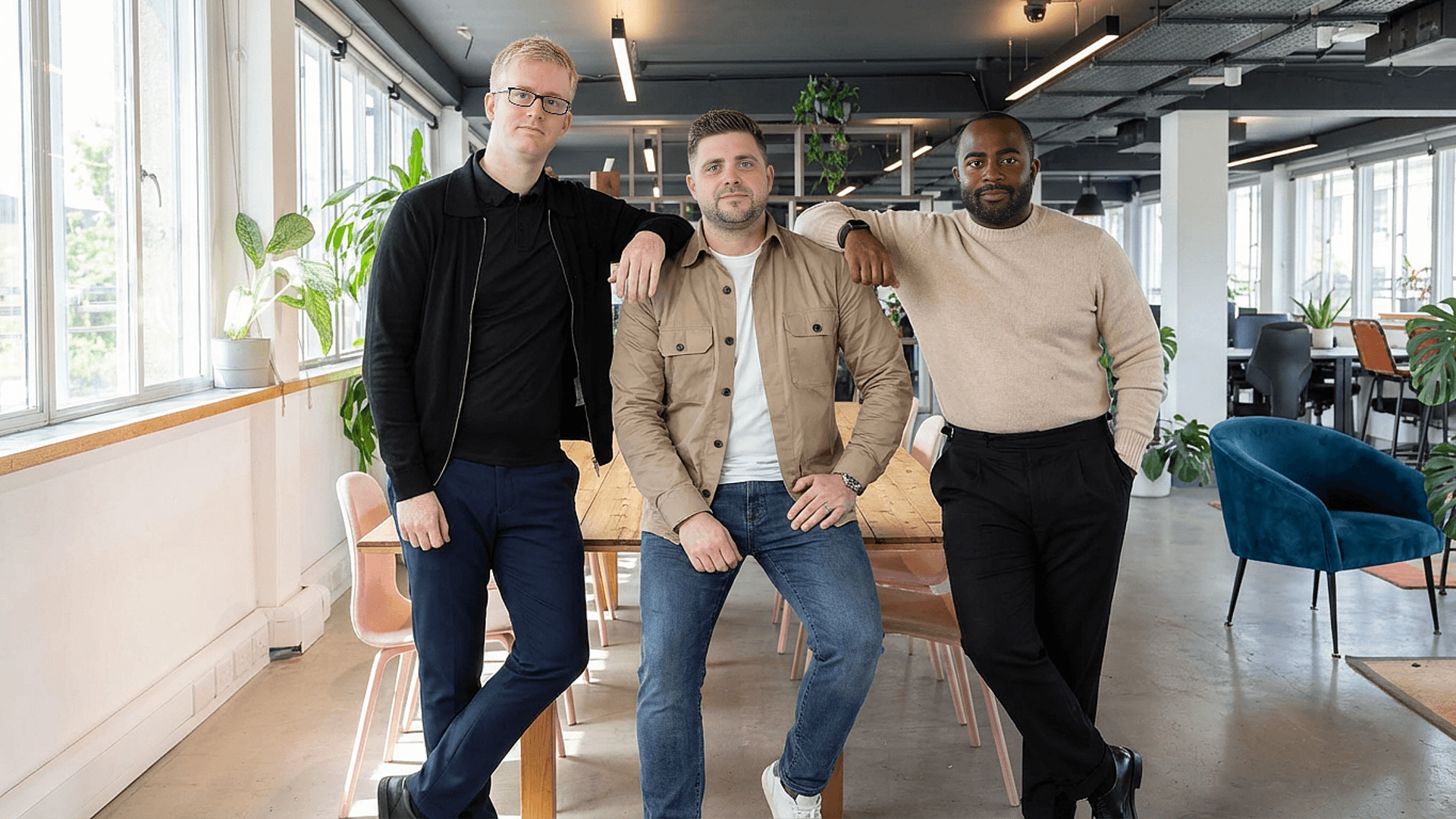

Founded in 2024 by FX and treasury specialists Alex Charles, Pierre Anderson and Martin Lee, Bracket aims to close that gap. Its AI-powered platform centralises bank accounts, automates FX workflows and provides real-time treasury insights within a single system. The goal is to reduce operational risk, improve decision-making and eliminate reliance on spreadsheet-based processes.

According to Co-CEO and Co-founder Pierre Anderson, mid-market firms are often held to the same financial standards as large corporates, but without access to comparable infrastructure. Bracket’s platform is designed to automate treasury operations and give finance teams direct control over bank data and FX exposure in one unified environment.

A Bank Distribution Strategy

Beyond serving corporates directly, Bracket has developed a bank distribution model, licensing its platform to financial institutions so they can offer modern treasury tools to their own customers.

This includes collaboration with Macquarie Group, which uses the technology to enhance its mid-market treasury offering.

By combining direct enterprise sales with bank partnerships, Bracket is positioning itself as embedded infrastructure within existing financial ecosystems.

Scaling Across Europe And Australia

The newly raised capital will support further product development and international expansion. The company plans to open additional offices across Europe and Australia while growing its team over the coming year.

About Bracket

Founded in 2024, Bracket is a digital treasury platform that provides global cash visibility and FX control for mid-market finance teams. By integrating with banks and ERP systems, the platform replaces spreadsheet-based processes with automated workflows, offering real-time insights, forecasting and hedging guidance in a scalable, enterprise-grade solution.