Andreessen Horowitz has raised more than $15 billion in new capital, further strengthening its position among the world’s largest and most influential venture capital firms.

According to co-founder Ben Horowitz, the new funds account for more than 18 percent of all venture capital allocated in the United States in 2025. With this raise, the firm’s assets under management now exceed $90 billion, placing it alongside long-established global players such as Sequoia Capital.

A multi-fund strategy spanning growth, AI, biotech and defense

The newly raised capital is distributed across five core funds. The largest allocation, $6.75 billion, is dedicated to growth-stage investments. Two additional funds of $1.7 billion each will focus on applications and infrastructure. A further $1.176 billion has been earmarked for the firm’s “American Dynamism” strategy, while $700 million is allocated to biotech and healthcare. The remaining $3 billion will support other venture strategies across the firm.

Andreessen Horowitz now operates across five offices in the United States, with teams in California, New York and Washington, D.C., and has expanded internationally with staff across six continents. In late 2024, the firm opened its first Asia-based office in Seoul, focused on crypto investments.

Limited partner opacity and sovereign capital ties

Andreessen Horowitz continues to disclose little publicly about its limited partners. While the firm has historically avoided transparency around capital sources and fund performance metrics, some institutional relationships are known. In 2023, California’s public pension fund CalPERS invested $400 million, marking a notable shift toward more traditional institutional capital.

The firm has also been linked to sovereign wealth capital. Sanabil Investments, the venture arm of Saudi Arabia’s Public Investment Fund, lists Andreessen Horowitz among its portfolio holdings. Senior firm leadership has publicly engaged with Saudi-backed initiatives, including appearances at conferences supported by state-linked investment entities.

Political proximity and the rise of American Dynamism

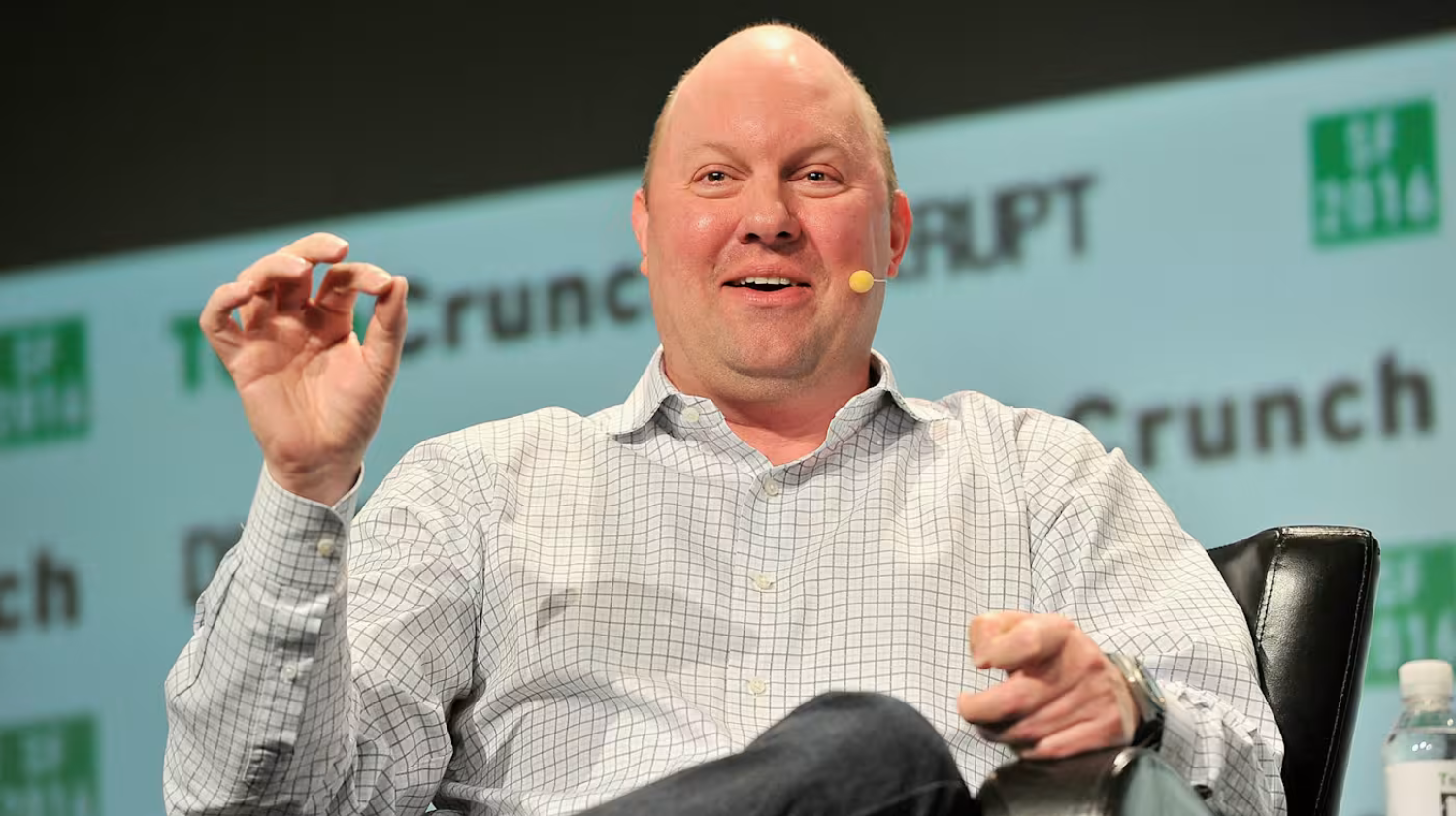

Andreessen Horowitz’s investment strategy increasingly aligns with national industrial and security priorities. Co-founder Marc Andreessen has become an active figure in U.S. policy discussions following the 2024 presidential election, spending time advising on technology and economic issues.

The firm’s American Dynamism fund targets sectors such as defense, aerospace, manufacturing, education and housing. Portfolio companies include defense and autonomy startups aligned with U.S. and allied government priorities, reflecting a broader thesis around reindustrialization and domestic supply chain resilience.

Andreessen Horowitz has argued publicly that the United States faces strategic vulnerabilities in manufacturing capacity, particularly in defense-related production, and sees venture-backed technology as a lever to address these gaps.

A broad bet across the AI stack

Artificial intelligence remains a central pillar of the firm’s strategy. Andreessen Horowitz has invested across infrastructure, foundation models and applications, building exposure at every layer of the AI ecosystem. Its portfolio includes companies in data platforms, large language models and consumer-facing AI products.

This approach reflects a high-risk, high-reward thesis that positions the firm to benefit regardless of which layer of the AI stack captures the most value over time.

Track record, ambition and scale

Over its 16-year history, Andreessen Horowitz has backed a large number of high-profile outcomes, including IPOs and major acquisitions. Market data providers estimate the firm’s portfolio includes more than 100 unicorns, dozens of public listings and hundreds of acquisitions.

In a recent blog post, Ben Horowitz described the firm’s role as central to shaping the future of American technology, framing its mission around long-term national competitiveness rather than individual fund cycles.

Whether that ambition translates into sustained returns remains an open question. What is clear is that Andreessen Horowitz has become exceptionally effective at raising capital at scale, positioning itself at the intersection of venture capital, geopolitics, AI and industrial policy.