Bosch Ventures, the corporate venture capital arm of the German tech giant, has unveiled a new $270 million fund — its sixth to date — with a clear intent to increase investment in North American startups.

While the firm has long invested globally, this fund marks a strategic pivot toward U.S. innovation hubs, despite current geopolitical and economic uncertainties.

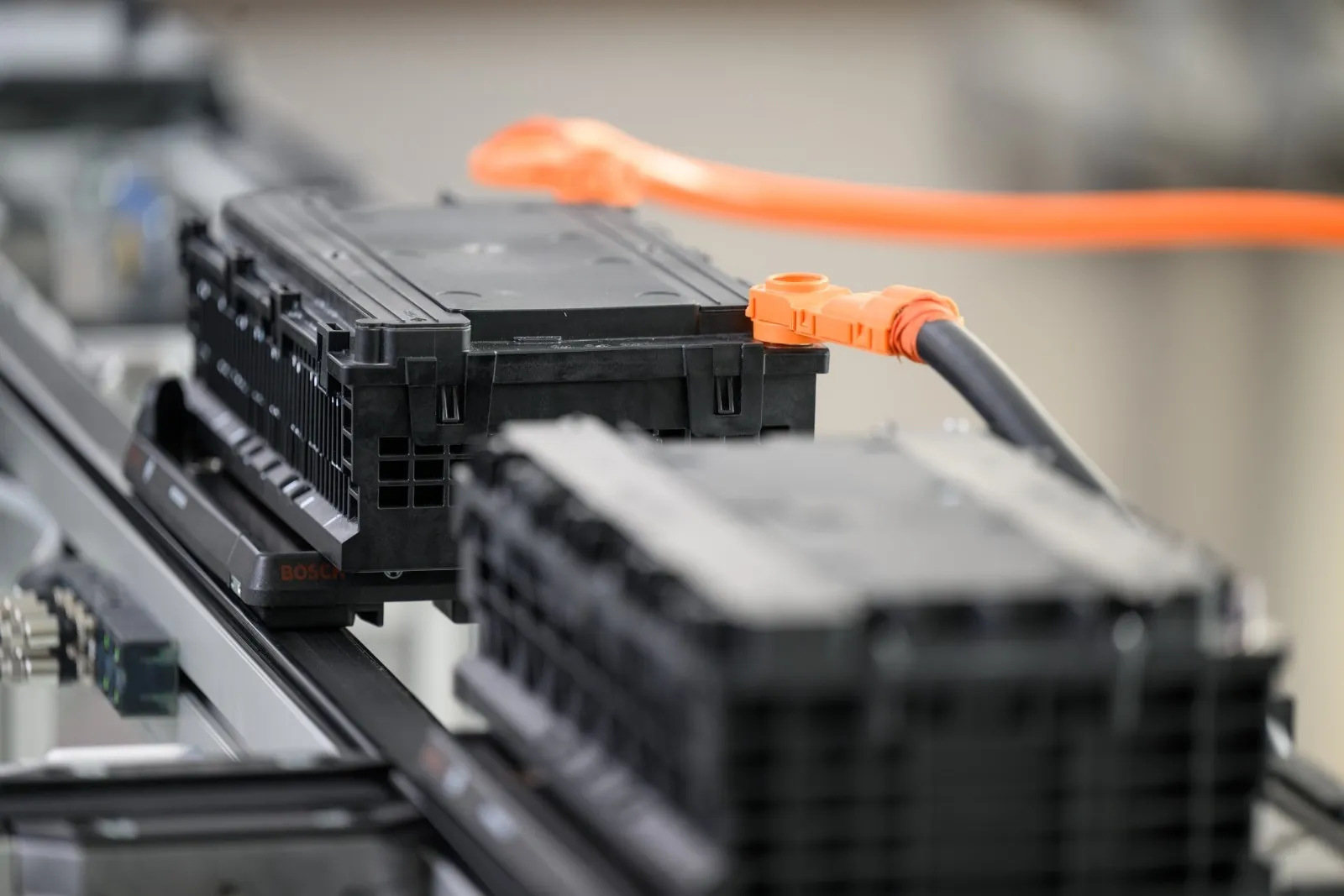

Managing Director Ingo Ramesohl emphasized that the U.S. startup ecosystem remains vibrant. “People are not stopping to innovate and not stopping to disrupt,” he told TechCrunch, pointing to a healthy deal flow across sectors like automotive, semiconductors, climate tech, and enterprise software.

A focus on AI with industrial roots

Although generative AI is dominating headlines, Bosch Ventures is specifically interested in its application to physical systems and manufacturing. Ramesohl noted that the firm is less focused on general-purpose AI and more on technologies that improve industrial processes, energy efficiency, and cybersecurity.

This is a natural extension of Bosch’s long-standing commitment to AI, anchored by its Bosch Center for Artificial Intelligence, which has helped embed AI into all Bosch product lines since 2023.

Global reach with local intent

With offices in Silicon Valley, Boston, Germany, Tel Aviv, and China, Bosch Ventures will continue to operate globally. But the new fund will prioritize 20–25 investments in North America, typically ranging from $5 million to $10 million per startup.

Ramesohl calls this fund a continuation of previous success stories — a signal that Bosch sees long-term opportunity in backing startups that bridge deep tech with real-world impact.